What is Clik2pay?

Clik2pay allows customers to pay directly from their bank account, based on the familiar and trusted Interac® e-Transfer service.

After selecting Clik2pay as the payment method, the customer chooses his or her bank directly with Interac. The purchase is conveniently populated with the amount to be paid, the merchant/organization name and any desired messaging. The customer logs in to their bank and confirms payment.

For the merchant, the payment is confirmed in real-time and final (i.e. no chargebacks).

Clik2pay Benefits

Reach more customers- Over 40% of Canadians prefer to pay from their bank account. Debit card exceeds credit card transactions at many merchants in Canada, but there is no equivalent option online.

- Clik2pay is based on the Interac® e-Transfer service, which enables access to more than 98% of deposit accounts, and is used by Canadians over 1 billion times per year.

- Many important customer segments (younger, new to Canada, credit challenged) do not have access to a credit card, leaving on-line purchasing out of reach.

- It's easy for customers to pay from any major Canadian financial institution, in just a few clicks.

- Clik2pay saves up to 50% vs credit cards. No hidden or confusing charges.

- No chargebacks: With real time, guaranteed payments, customer payments are final and secure.

- No PCI: With no card data captured, Clik2pay is outside the scope of PCI compliance standards.

- Reconciliation is automated, with a complete transaction file delivered next day.

- Plug-in available for Magento, Salesforce and Shopify platforms, with Woo Commerce also available by the end of 2022.

Many customers want to pay direct from their bank account

Consumers want to pay with debit- Debit payment in Canada has exhibited double digit growth in the last 5 years. In 2020, debit accounted for 47% of all card payments, compared to credit card at 51% and prepaid cards at 2%. (Payments Canada Canadian Payment Methods & Trends Report 2021)

- Debit payment may now exceed credit, as is the case in the US as of 2022. (S&P Global Market Intelligence)

- Top reasons for using debit include ability to use own funds, convenience and keeping track of expenses. (Payments Canada)

- Online transfer transactions in Canada grew by 48% in 2020, with Interac® e-Transfer accounting for 95% and PayPal 5%. (Payments Canada)

- Over 1 billion Interac® e-Transfer transactions have taken place in the past 12 months. (Interac)

- 45% of Interac® e-Transfer users have used the service to pay a business or a bill. (Payments Canada)

- Top reasons for using online transfers continue to be speed, convenience, and security. (Payments Canada)

- 15% of Canadian cardholders have a credit limit of less than $2,000. (Finder)

- An additional 7% of adult Canadians do not have a credit card. (Payments Canada)

- Accounts for 14% of ecommerce $ volume in Europe. (FIS Worldpay Global Payments Report 2022)

- Transactions are up by 41% globally in 2021. (McKinsey)

- 46% of Europeans have made a direct-from-account payment in the past month. (Token)

- Becoming dominant in countries with an interbank debit network such as Interac. In The Netherlands (Ideal Network), direct-from-account payments now exceed 70% of ecommerce $ volume. (eCommerce Payment Monitor)

- US payments providers and merchants are preparing for direct-from-account payments, given the US Federal Reserve's FedNow (real-time payments) initiative launching in 2023.

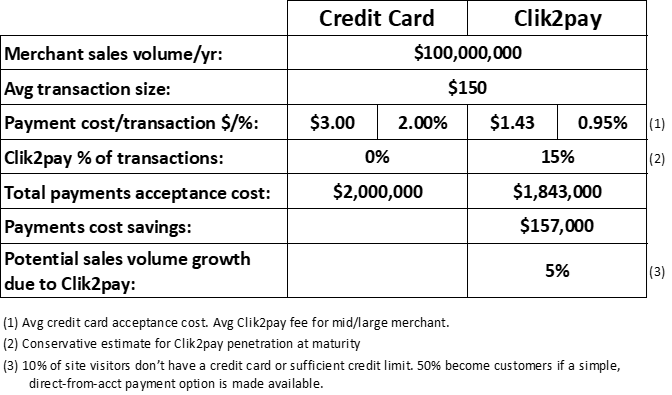

Clik2pay economics are compelling

Try it! Donate $5 to Make-A-Wish Canada

To see a Clik2pay payment transaction in action, scan the Clik2pay QR code. You will be brought to the Interac® e-Transfer page, inviting you to make a $5 payment to the Make-A-Wish Foundation. You can select your bank, log-in, and then confirm the payment – see how easy it is!

Contact Us for more details or give us call 416 879 8623. We will be happy to serve you 24/7.

View Partner Site